I wrote last month about my first big flub as a first-time home buyer. You can read about it here. But the gist was that we didn’t get a loan large enough to cover the upgrades that we wanted to make to our home. From fixing sewage pipes to remodeling our kitchen, we are paying cash to make the upgrades and living off of credit cards.

So I thought I’d give you an update about how it’s all going…and in a nutshell, it’s HARD.

I’ll start off by saying, I’m not hoping for a pity party here. We are extraordinarily fortunate. We just bought a house, a really cute one, so I’m not all like boohoo or anything. I’m sharing this story in case anyone who may be in a similar position now or someday may take something away from this that may be helpful.

So first things first, remodels are expensive. We knew that going in. We also knew that our contractor doesn’t take credit card, so pretty much every week for the past six weeks we’ve been handing him a large chunk of change (whatever was left of our savings after buying the house) to complete the remodel. When we got the original estimate and we could handle it financially, but as the weeks passed we ended up added things on: we found mold and rotting wood in the kitchen once the walls came down, we decided to remove the popcorn ceilings, we realized we needed an outlet in the backyard…It was all small stuff, but little by little the small stuff totally adds up. So lesson number one:

1.) Whatever the estimate is from your contractor, calculate (at least) an additional 20% for unforeseen matters.

Next up, don’t forget that moving costs money (and time!). Now this may seem obvious, but I was so busy trying to cover all of the costs for the new house, that I kinda forgot that moving is also very expensive. While many times I ‘kiss goodbye’ to rental deposits, I couldn’t do that this time because we really need the cash. So besides moving all of our stuff (and we have a fair amount) we also had to repaint, clean, scrub the house and fix up the yard at our old house which was a HUGE job. We even paid more than $200 for someone to come and haul away all of the stuff that wasn’t nice enough to hand off to Goodwill. That really hurt. The lesson here?:

2.) A.) Put aside money for the move. B.) schedule a junk pickup with the city. The city will come and haul trash away but you have to make an appointment first. We didn’t schedule that in advance and we ended up losing money. Also remember it takes 21 days (at least in California) to get rental deposits back, so don’t plan on using that cash right away to pay for any of the moving costs.

Next, what has been making this situation even more challenging and stressful is the fact that I am a freelancer. If either Jason or I had a steady income, this situation would be much more mellow. We’d know exactly when we’d be getting our next paycheck. But being a full-time freelancer means that not only do I not know where the next pay check is coming from, I don’t know when it’s coming. Most companies I work with pay 30, 60, 90 and even 105 days from the time that the job is done–which means I’m waiting on checks for work I completed in March. Yikes. What’s the takeaway here?:

3.) If you know you’re moving, and you work freelance, try and negotiate clients to pay half upfront–this may help the income flow in at more regular intervals as opposed to going months with no pay and then getting a fat check.

And the last lesson I’ll discuss today is about managing stress an expectations. This is the first time in my life I’ve ever racked up credit card debt. This is the first time in my life I’ve owed money to people. Even though companies take a long time to pay me, I’m not used to making people that work for me wait to receive payments. In fact, the idea of making people wait for money that they have earned, makes my stomach churn. I check my bank app about every 30 minutes to see if any payments have come in and I have been selling stuff left and right to try and cover my ass. So the last takeaway here is:

4.) Manage your own stress and expectations, as well as others’. I’m still working on this but I’m basically doing what I can to be open and communicate clearly with people who work with me, explaining that although I normally pay immediately upon receiving invoices, this month it’s going to take me 30 days to process payment. I’m also putting everything that I can on credit cards–even tax payments–(which means I pay a penalty). I’m doing this because it’s less stressful for me (and better for my small army of freelancers) to owe the bank money than real people–even if at the end of the day I’m paying a bit more in interest and fees…(especially since I owe them money because I’m remodeling my kitchen–it’s not like family emergency or something..thank goodness…)

And that’s about it. The good news is, I see a light at the end of the tunnel. I think that my stomach will continue to churn for about 30 days until more paychecks come in and debts are paid off. But lots of lessons learned and, I’m sure, still more to learn as time goes on…Any thoughts? How to you handle the stress (and logistics) of moving and remodeling a new home??

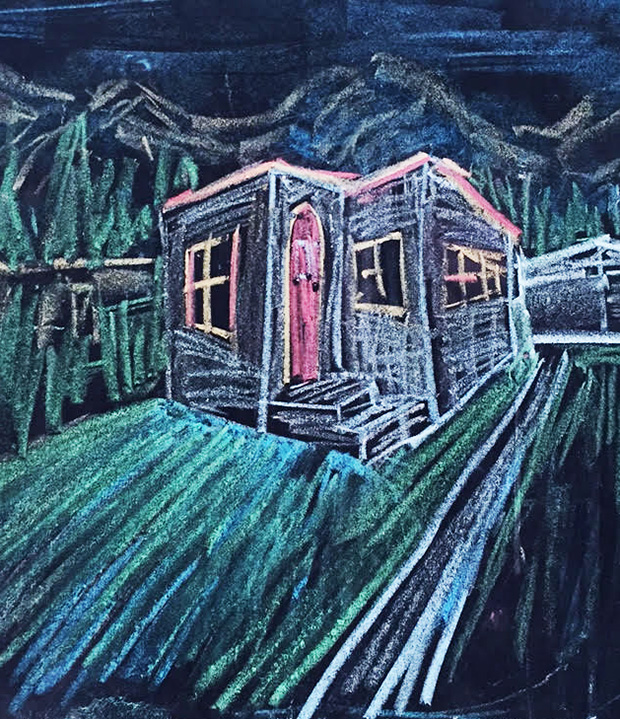

The sketch above was one that Jason (my husband) did on Ida’s chalkboard of our new house when we first put a bid on it…)

The thing that I love about this blog so much is how honest you are about shit. Everything is beautiful, but nothing is perfect. I’m going through something similarly right now and it’s just so hard not to lose it. Managing money coming in and money coming out is SO hard. Thanks for sharing some truth. Your kitchen is looking so beautiful! xo

Yes it’s so tough, and stressful. I hate it!! But this too shall pass and thanks for your kind words! Hang in there!

Hang in there girl! I just wanted to comment and say that I really appreciate you being so open and transparent about these issues. I come for the pretty plants and interiors, but I stay because you’re such a genuine voice that cuts through the noise. I’m about 6 months away from looking for my first house, and these posts are SO HELPFUL!!! Sending you and your sweet family good vibes!

So great to hear that they’re helpful–that’s really my aim. I just wanna share all the shit that I wish someone would have told me going in, you know? Anyway thank you for chiming in and for your encouragement–it means a lot!

Thank you for sharing!! This is the stuff that is REAL, and really helpful! I’m about to have a few financial headaches of my own and this gave me hope. xo

I’m not a frequent blog commenter, but wanted to echo the sentiments above and let you know how much I value your openness about the whole homebuying/lending/renovating process. Money is SO hard to talk about sometimes, especially when you’re struggling. My husband and I just bought our first house and it’s the first time we’ve ever had debt as well and it is so. so. stressful. It’s easy to think you’re the idiot and that everyone else has it all figured out, ESPECIALLY on the internets. So thanks for the inspiration (your kitchen is amazing) and the honesty. This really helps.

I second everyone who already commented – and thank them for their honesty as well! Thank you Justina, for sharing your struggles as well as your joyous successes – I too am having a hard time and it means so much to know I’m not alone. I try not to but I spend so much time comparing myself to my friends who *seem* to have it altogether and feeling pretty low about myself. Your lessons help us all :)

love this post and your transparency…no one ever talks about this stuff when talking about homes..xoxo

Thanks for the transparency! We’ll be doing a reno one day so its very nice to learn about things most people would rather not talk about. Wishing the best for your family. The kitchen looks amazingly jungalicious so far.

I want to join the choir and say it’s a great and very helpful post. As somebody who extensively remodels right now-I can just honestly tell I’m not great at handling this stress. So not much advice, unfortunately. The only thing I’ve been telling myself-all in all, it’s first world problems. They don’t shoot around here yet? Already grateful. LOL.

(our house turned out to have asbestos-our great and very detail-oriented home inspector found it out when looking at some pipes in the attic, just by chance. We then got scared and asked for special inspection for asbestos-normally home inspectors won’t get into the walls or floors, so if it’s not exposed somewhere-you’ll never know. And it was used from the befinning of the 20 th century, to eighties.It was considered a great material.

Long story short. It turned out this thing was everywhere. Drywalls, floors. We could still back out of escrow. We almost did, but then we didn’t. We decided we’re going to handle it. Grave mistake. It added tens of thousands of dollars, on top of other things. It also added to remodel timeline, and we’re paying two mortgages for months already.

It’s the first time in my life that first thing that goes through my mind, when invited to a party for example: “I’ll have to buy a present, and to bring the food, and I don’t have much money right now”

I feel so ashamed, because even as a poor, poor student owning exactly two pairs of jeans-I never thought this way. Maybe because when you’re young, you worry so much less. You’re energetic, healthy, have hopes, you’re not responsible for lots of people yet..

Now every (stupid) decision you make, affects so many people.

So yes, it is stressful as hell. And no, I don’t feel extremely creative right now. It’s hard to be creative when your main emotion is fear.

So your blog helps a lot. You don’t even know how much it helps. Hang on there. Vinceremos(c))

We bought about three years ago and learned some of this the hard way too. We were lucky to minimize some expenses, but even with friends helping to pack and unpack on both ends, renting a UHaul costs! And I too cleaned like a son-of-a-gun to ensure we got the whole rental deposit back. Hoo boy! The house wasn’t that clean while we lived there! (Kidding. Sort of.)

The big stress for us is that less than six months after buying our house my husband was laid off and went from steady pay to freelance, and very unsteady pay. Luckily we can afford (just) the mortgage on my paycheck. But not all the plans we had for changes and improvements. So you do what you have to, and yes… manage your expectations. We still have plans for renovations, but it’s cut into waaaaay smaller steps than we’d planned at first. Patience. It’s a virtue, I guess.

Good luck! I think it sounds like you’re approaching it with smarts and a solid attitude.

Wow, your honesty and transparency here is so impressive. Kudos to you, just for posting this. I’m not at this point in my life, but know that somewhere down the line, I’ll be buying a house and likely looking to remodel as well, and these are great takeaways. I appreciate how upfront you are about using credit cards for expenses for the first time – that’s something I think we all try to avoid, but once you’re in a situation, it can be the only option. I think the biggest takeaway is to be responsible, and prioritize who needs the money now, and who can wait. Good luck with your reno, I’m sure your home will be beautiful when it’s finished!

We bought our first home together in 1986. We wanted a home with “chatacter” and found a home built in 1897 in a beautiful location in a good school district. We had to gut every room & knew that going in. But one thing is that my husband is an engineer who can fix anything. We did ALL work ourselves, and paid as we went. It took us 7 years, and we had 4 kids during that time. If you have to hire a contractor, thats a different deal altogether, as you will have to pay for each thing, like that outdoor outlet.it was hard to live in a home under construction, but we absolutely LOVE our home. We now have a 4,000 sq. ft. House with 5 bedrooms & 3 full baths. It took patience, time & perseverance, but it was,worth it. And BTW, we paid as we went. I think what Justina did is very brave – not sure I would have that much courage!

Wonderful honest and informative post.

You are amazing. So many people try to put on a front and pretend everything is perfect but this post is raw and real and I LOVE it. Has your husband ever thought about selling some art for extra income?! Looks like he has some skillz ;)

Hi Justina- The only reason I managed my first mortgage was by taking boarders in, if you have the room it can work well, I survived it by making a rule of only renting to Art Students that were studying hard at Uni, thus had no time to get in my way.

In house 2 now on half an acre of Gum Trees (Australia) not as much studio space, but it is design heaven.

Good luck, you are one up on me, I had to do it alone!

Love and Peace

Phoebe

Until I read this post I had residual regrets about buying a new house with no character instead of the old fixer upper I loved when you all were kids. I guess it was a trade off. Mi missed the opportunity to make our family house our own project, and I never thought about the tsurris and stress I missed.

Who Boy! Don’t I know about it. Again, thanks for being honest. I love your blog and I so look at your fabulous life and think, ‘wow, it must be nice.’ I don’t exactly get pleasure in knowing that you have struggles too, but it helps to know that we all have them. I’ve been in my house for 7 years now, and I’m just now at a point that I’m really considering that we either remodel or move. In the next few months, we will (hopefully) be adding that much needed 2nd bathroom (seriously much needed with a teenage girl included in the 5 people in this family). Every time I turn around I see a project (and simultaneously hear ka-ching! in my head). It’s crazy-making, but we will all get through it.

Thank you,thank you, thank you, for your honesty and candor. I am going through the exact situation being a freelancer and the main provider in our household wih a little one… and buying and selling and renovating. Omg, is it stressful! It’s so easy to look at social media and see all the fantasy and glitter, but rarely do people share the reality and I thank you for that! Best wishes for smooth sailing from here on out! Xoxo

Hi to all, the contents present at this web site are truly remarkable for

people experience, well, keep up the nice work fellows.

Thanks for the advice. Your story is very close to me. My wife and I bought a new house, and we also needed urgent repairs. After two months of shopping, I got fired from my job and lost a lot of money. It was very terrible, and I didn’t know what to do. Fortunately, my wife had a small clothing store. And I joined her. And this allowed us to stay afloat. But the renovation is still dragging on, and we do not know when we will finish it.

wow!!! What a blog. The way you explain it the way you use this word is mind-blowing. I just love this. Thanks for spreading this knowledge to us.

i have never found such an informative post thanks for sharing it.

i’m thankful for such amazing content.

i’m thankful for such amazing content.

Fantastic

i’m thankful for such amazing content.

I was searching for a Research based pharma company blog, but found your blog about the business of being boho: money matters. Thanks for sharing the information. I found the information very useful. A great article to read. I appreciate you spending some time and effort to put this article together.

wonderful post keep sharing more

Toronto Airport Limo Service is an exclusive luxury limo service provider in Toronto, Canada that strives for excellence and quality of service with impeccable luxury class fleet and devotion to serve with perfection as a airport transport limousine service.

Minivan Airport Taxi

There’s a new kind of gold rush happening, but instead of pickaxes and dusty trails, it involves servers and fiber optic cables. IP addresses, the unique identifiers that let devices talk to each other online, are becoming increasingly valuable as the digital landscape expands. Companies like IP.Gold are capitalizing on this by acquiring these digital assets and building an entire ecosystem of services around them, from email to cloud storage. Think of it as a tollbooth on the information superhighway, collecting a steady stream of revenue that gets shared with investors. Unlike some flashy ICOs, IP.Gold already has a proven, profitable business model in place. So, if you’re looking for an investment that’s less like a lottery ticket and more like a well-oiled machine, IP.Gold might be worth a closer look https://ip.gold/.